Nomadicsage.com @2024

Nomadicsage.com @2024

Insurance is an important safeguard for your travel plans, providing you with peace of mind when you begin on your adventures. With the ever-changing uncertainties of travel, such as trip cancellations and medical emergencies, choosing the right policy is paramount.

To help you navigate through the options, we’ve compiled a list of the best travel insurance companies in the USA, focusing on their coverage plans, customer service reputation, and value for your money.

This guide will empower you to make informed decisions that protect your journeys and finances effectively.

While planning your next trip, it’s imperative to consider the role of travel insurance. This protective measure not only safeguards your financial investment but also provides peace of mind, allowing you to enjoy your journey without worrying about unexpected events.

For travelers, emergencies such as flight cancellations, lost luggage, or natural disasters can disrupt your plans, leading to significant financial loss.

Travel insurance acts as a shield against these unforeseen interruptions, ensuring you are compensated for extra expenses incurred due to delays or cancellations.

At any moment during your travels, medical issues can arise, making coverage for these emergencies extremely important.

Travel insurance provides you the security you need, ensuring you have access to necessary medical care, even in unfamiliar locations.

The importance of medical coverage while traveling cannot be overstated. Accidents and illnesses can happen anywhere, and you may face exorbitant medical bills if you aren’t insured.

Travel insurance can cover expenses such as hospital stays, doctor visits, and emergency evacuations, which can easily reach thousands of dollars without coverage.

Your policy should also include 24/7 assistance services, ensuring you can seek help quickly and easily when you need it most.

Protecting yourself with travel insurance not only gives you access to imperative medical care but also offers you the comfort of knowing you’re covered in an emergency.

Assuming you want the best travel insurance, consider these factors to ensure that your needs are met:

You should compare offerings from various providers to find the right plan for your travel needs.

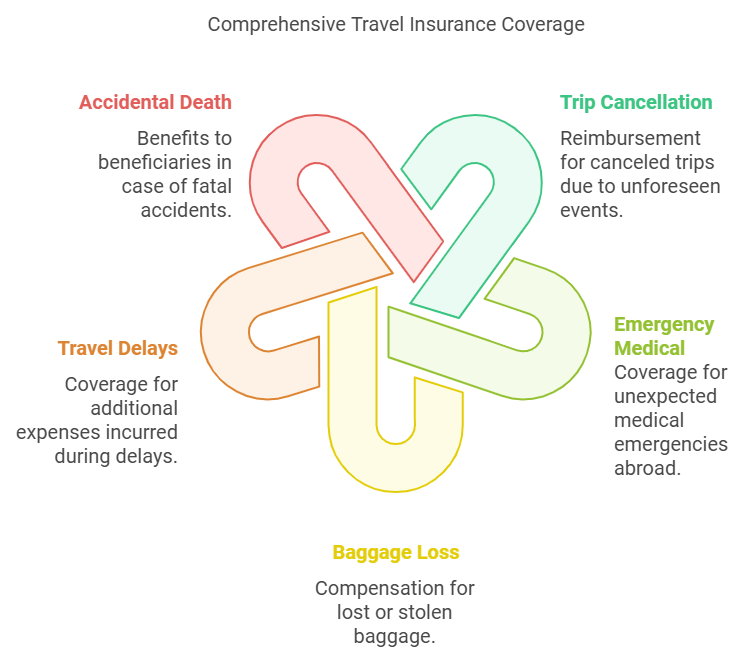

Above all, understanding the different coverage types available is necessary.

This knowledge helps you select a policy that covers your unique travel risks.

| Coverage Type | Description |

| Trip Cancellation | Reimbursement for canceled trips due to unforeseen events. |

| Emergency Medical | Coverage for unexpected medical emergencies abroad. |

| Baggage Loss | Compensation for lost or stolen baggage. |

| Travel Delays | Coverage for additional expenses incurred during delays. |

| Accidental Death | Benefits to beneficiaries in case of fatal accidents. |

Beside understanding coverage, you must review the policy limits and exclusions that may apply:

At times, policies will outline a maximum payout, so it’s necessary to know the limits for each type of coverage. Additionally, exclusions can significantly impact your protection, as they detail situations or events not covered by your policy.

Always read these sections carefully to avoid surprises.

Choosing a travel insurance provider with excellent customer service and a straightforward claims process is vital.

Factors such as response time, accessibility, and the simplicity of their claims procedure can significantly affect your experience.

Effective customer service ensures that you can get assistance when you need it, while a streamlined claims process allows you to receive your benefits quickly and easily in times of need.

To ensure a worry-free journey, selecting the right travel insurance provider is vital. The market is filled with various options that cater to different types of travelers, offering plans ranging from basic coverage to comprehensive packages.

Understanding the nuances of each company can help you make an informed choice while protecting your investment and peace of mind during your travels.

On your travels, Allianz Travel Insurance stands out with its extensive range of plans tailored to your specific needs. They offer 24/7 customer support, making it easy for you to get assistance whenever necessary. Their policies include coverage for trip cancellations, medical emergencies, and lost luggage, ensuring your travel experience is safeguarded.

Among the most popular providers, World Nomads offers specialized coverage for adventurous travelers.

This company is particularly well-suited if you plan to engage in activities like hiking, skiing, or diving, as their plans specifically cater to such pursuits.

Their policies are flexible, allowing you to extend your coverage while traveling.

Allianz offers additional peace of mind as they provide coverage for a wide variety of activities and destinations.

Their plans include medical coverage for injuries sustained during activities and trip interruptions, ensuring that you can indulge in your adventures without the burden of worrying about what could go wrong.

After examining the various options, Travel Guard emerges as a reliable choice for your travel insurance needs. Known for their customizable plans, they provide coverage for trip cancellations, emergency medical expenses, and various travel liabilities.

In addition, Travel Guard offers assistance services to help you navigate unexpected situations abroad.

Further enhancing your travel experience, Travel Guard features a “satisfaction guarantee” on select plans, allowing you to travel with increased confidence.

They also provide a user-friendly mobile app to help you manage your policy and access travel assistance on-the-go—making it easier to stay informed during your journey.

Between the top contenders, AXA Assistance USA is recognized for its comprehensive coverage and excellent customer service.

They provide plans that include trip interruption, emergency medical, and personal liability coverage, ensuring a protective layer throughout your travels.

Their expertise in global travel insurance helps you handle any unexpected situations efficiently.

Even more reassuring, AXA Assistance USA offers a robust claims process and has received positive feedback for their quick response times.

Their services cater to both leisure and business travelers, making it easier for you to find the right plan that fits your specific travel needs.

After exploring various travel insurance options, it’s imperative to compare coverage and pricing to find the most suitable plan for your needs.

The Best Travel Insurance Companies of October 2024 offer a range of policies to protect you against unexpected incidents while traveling.

Here’s a quick overview of what to expect in coverage options and pricing:

Coverage Options vs. Pricing

| Coverage Options | Pricing |

|---|---|

| Basic Plans: Medical emergency, trip cancellation | Starting at $25/month |

| Comprehensive Plans: Medical, cancellation, baggage loss | Starting at $50/month |

Options vary extensively between basic and comprehensive plans. Basic plans typically cover emergencies and cancellations, making them suitable for budget-conscious travelers.

In contrast, comprehensive plans offer more extensive coverage, including baggage loss and trip delays, which can be worth the additional cost for frequent travelers.

By evaluating travel insurance costs, you will find that several factors influence your premium. Plans typically vary based on destination, age, and coverage level, affecting overall pricing.

It’s wise to analyze what you value most in coverage to match it to your budget.

Indeed, striking a balance between affordability and adequate coverage is imperative.

Price shouldn’t be your only focus; instead, ensure you are protected against potential risks, including cancellation fees, medical emergencies, and unexpected travel interruptions.

A slightly higher premium may provide substantial peace of mind, making your travels smoother and more secure.

Keep in mind that there are several myths surrounding travel insurance that can lead you to underestimate its importance.

Many travelers believe that their existing health insurance or credit card coverage is sufficient during a trip. However, these plans often do not cover all potential travel-related incidents.

To learn more about what to consider, check out this article on International Travel Insurance: 5 Best Options for 2024.

Above all, it’s necessary to know that your health insurance may not cover overseas medical treatment. Many U.S.-based insurance plans provide limited or no coverage when you venture outside the country.

Additionally, unexpected expenses such as evacuations or trip cancellations can arise, leaving you vulnerable without proper travel insurance.

One significant misconception is that all travel insurance policies offer the same protection.

In reality, there are various options tailored to different needs, including coverage for trip cancellation, emergency medical treatment, lost luggage, and more. It’s vital to assess your personal travel circumstances to ensure you choose the right plan.

Health insurance plans vary widely, and not all travel insurance is created equal. Each plan has distinct features and exclusions that can affect your protection level.

For instance, some policies may cover trip interruptions, while others specifically exclude certain activities like extreme sports.

Understanding these differences can help you secure a policy tailored to your unique travel requirements, ensuring you’re protected when unexpected situations arise.

Your travel insurance journey may raise some questions. In this section, we address the most common inquiries travelers have about purchasing and utilizing travel insurance. From the best time to purchase coverage to how to file a claim, we aim to provide clear and concise answers to ensure you make informed decisions.

Behind the scenes, travel insurance is best purchased right after you book your trip. This strategy offers you immediate protection against unforeseen events, such as trip cancellations or medical emergencies, giving you peace of mind as you plan your adventure.

After securing your insurance, you may need to file a claim if something goes wrong during your travels. It’s important to act quickly and follow your insurance provider’s specific claim process for the best chance of a successful resolution.

File your claim promptly by gathering all necessary documentation, including receipts, medical reports, and incident details.

Provide thorough information, as insurance companies require specific evidence to process your claim. Make sure to keep copies of all documents submitted, as this can expedite the process.

If you experience difficulties or if the claim is denied, consider contacting your insurance agent for assistance. It’s imperative to understand that delays in filing can negatively impact your claim, so act swiftly!

Choosing the best travel insurance company for your needs in the USA requires careful consideration of factors such as coverage, customer support, and pricing.

By evaluating options like World Nomads, Allianz, and Travel Guard, you can find a policy that fits your travel plans and offers protection against unexpected events.

Prioritizing your peace of mind allows you to explore confidently, knowing you have the support you need in case of emergencies, cancellations, or medical issues while traveling.