Europe’s diverse financial landscape can be both exciting and overwhelming for travelers. From the euro to the Swiss franc, contactless cards to digital wallets, knowing the best payment methods for Europe travel ensures a smooth, cost-effective trip. This guide breaks down everything you need to manage money wisely across the continent.

Navigating European Payment Landscapes

Whether you’re island-hopping in Greece, exploring Scandinavian capitals, or wandering through Eastern European villages, your approach to payments will significantly impact your travel experience.

With nearly 30 different currencies across Europe and varying acceptance of payment technologies, preparing your financial strategy is as essential as packing your passport.

Let’s explore the most efficient and cost-effective payment methods for Europe travel to ensure your focus remains on making memories rather than managing money complications.

Understanding European Currencies in 2025

Europe’s currency landscape reflects its diverse political and economic history. While the euro dominates much of the continent, travelers need awareness of the various currencies they might encounter:

The Euro and Its Reach

The euro serves as the official currency in 20 European countries, including popular destinations like Italy, France, Germany, Spain, Portugal, Greece, and Croatia.

This single currency eliminates the need for exchanges when traveling between eurozone countries, simplifying budgeting and spending for visitors covering multiple destinations.

Beyond the Euro: Other European Currencies

Several European nations maintain their own currencies, requiring additional planning for multi-country itineraries:

- British Pound (£): Used throughout the United Kingdom

- Swiss Franc (CHF): Switzerland’s currency, also accepted in Liechtenstein

- Scandinavian Currencies: Including the Swedish Krona (SEK), Norwegian Krone (NOK), and Danish Krone (DKK)

- Eastern European Currencies: Such as the Polish Złoty, Hungarian Forint, and Czech Koruna

These currencies are not interchangeable, meaning trips combining euro and non-euro countries (e.g., London-Paris-Rome) require multiple currency preparations.

Always verify the accepted currencies for each destination in your itinerary to avoid last-minute exchange complications.

Payment Methods in Europe for Travelers: Options and Acceptance

The payment landscape across Europe continues to evolve, with significant advancements in digital options alongside traditional methods.

Understanding the practical applications and limitations of each payment method will help you prepare effectively.

Card Payments: Acceptance and Considerations

Credit and debit cards remain among the most convenient payment methods in Europe for travelers, with some important considerations:

- Universal Acceptance: Visa and Mastercard enjoy near-universal acceptance throughout Europe, making them reliable primary payment options

- Limited Acceptance: American Express and Discover cards face more restricted acceptance, particularly in smaller establishments and rural areas

- Contactless Technology: Europe has widely adopted contactless payment technology, with tap-to-pay available for small to medium purchases in most urban areas

- Chip and PIN: Most European payment terminals require chip-enabled cards, with PIN verification rather than signatures for security

For optimal convenience, travel with at least one Visa or Mastercard as your primary payment method. If you rely on American Express or Discover, always carry a backup Visa/Mastercard for situations where your preferred card isn’t accepted.

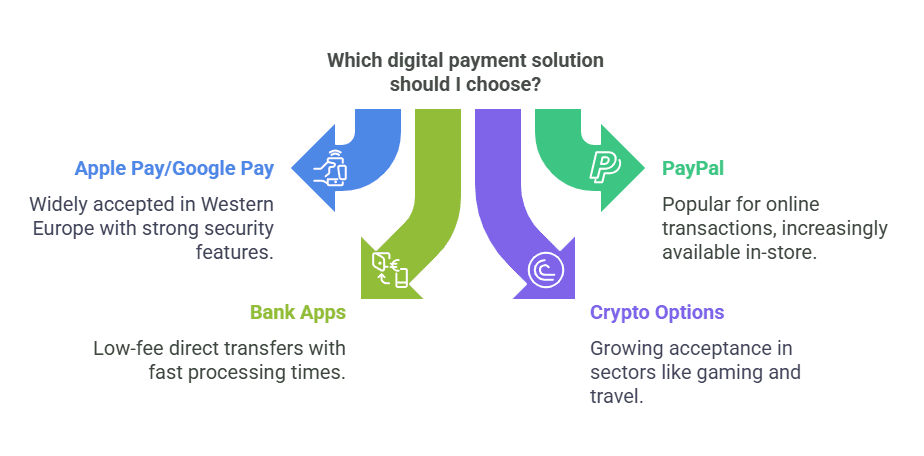

Digital Wallets and Mobile Payments

Digital payment solutions have gained significant traction across Europe, offering convenient alternatives to physical cards:

- Apple Pay and Google Pay: Widely accepted wherever contactless payments are supported, especially in Western European countries

- PayPal: Commonly used for online transactions and increasingly available for in-store payments

- Pay by Bank Apps: Direct bank transfer services like Payop offer low-fee alternatives with fast processing times

- Emerging Crypto Options: Bitcoin and Ethereum acceptance is growing in specific sectors like gaming and travel, though mainstream adoption remains limited

Digital wallets provide excellent security through tokenization and biometric authentication, reducing the risk of fraud compared to physical cards. However, they rely on device battery life and connectivity, making backup payment methods essential.

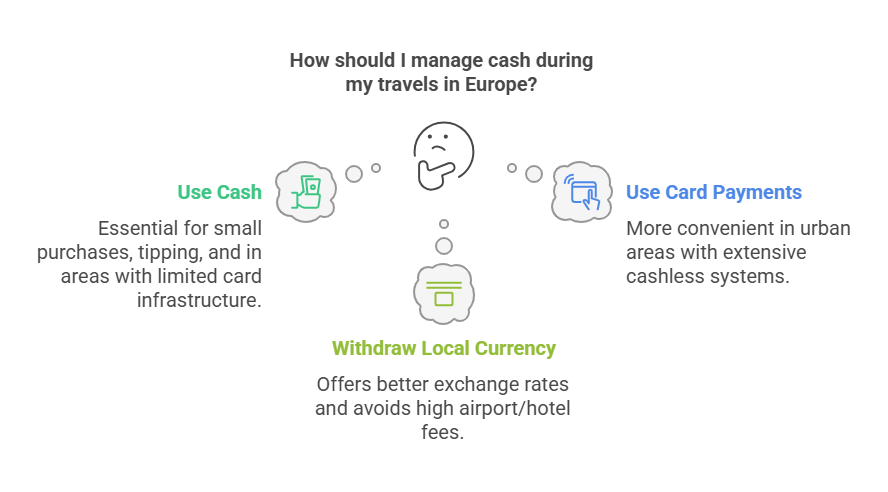

Cash Considerations and Strategic Usage

Despite the digital revolution, cash retains importance in many European contexts:

- Regional Variations: Northern and Western European countries have embraced cashless payments more extensively than Southern and Eastern regions, where cash remains prominent

- Small Purchases: Many small businesses, markets, and street vendors throughout Europe either prefer or exclusively accept cash

- Tipping: In countries where tipping is customary, cash tips are often preferred by service workers

- Rural Areas: Remote locations may have limited card payment infrastructure, making cash essential

For optimal preparedness, withdraw local currency upon arrival using bank-affiliated ATMs, which typically offer superior exchange rates compared to currency exchange services.

Avoid airport and hotel exchange counters, which often charge 10-15% in hidden fees through unfavorable rates.

Innovative Payment Options in Europe

Several innovative payment methods in Europe for travelers have emerged to address specific traveler needs:

- Mobile Payment Apps: Country-specific solutions like Swish (Sweden), MobilePay (Denmark), and iDEAL (Netherlands) have gained popularity among locals

- QR Code Payments: Increasingly common in tourist areas, allowing payments through smartphone scanning

- Wearable Payment Devices: Payment-enabled watches, wristbands, and rings gaining acceptance in major urban centers

- Real-Time Bank Transfers: Systems like SEPA Instant Credit Transfer enabling immediate euro payments between European accounts

While these methods may not form your primary payment strategy, awareness of these options can provide additional flexibility during your travels.

Travel Money Cards: Specialized Options for European Travel

Travel money cards represent a middle ground between cash and traditional banking products, offering specific advantages for international travelers.

Multi-Currency Travel Cards

These specialized debit cards allow loading multiple currencies on a single card, offering advantages for multi-country European journeys:

- Wise Debit Card: Holds over 50 currencies with mid-market exchange rates and limited fee-free ATM withdrawals

- Revolut: Offers excellent exchange rates with free ATM withdrawals up to certain monthly limits

- N26: Provides fee-free withdrawals at in-network ATMs (with limits) and no foreign transaction fees

These cards typically offer mobile apps for real-time balance management, currency exchange, and transaction monitoring, giving travelers greater control over their funds abroad.

Travel-Focused Credit Cards

Several credit cards cater specifically to frequent travelers with European-friendly benefits:

- Cards with No Foreign Transaction Fees: Options like Capital One Venture and Chase Sapphire Reserve eliminate the typical 1-3% fee on foreign purchases

- Travel Rewards Cards: Products like the HSBC World Elite Mastercard offer travel points/miles alongside European travel benefits

- Premium Travel Services: Higher-tier cards may include concierge services, airport lounge access, and travel insurance benefits

While these cards offer significant benefits, they often carry annual fees and higher interest rates, making them better suited for frequent travelers who can maximize the associated rewards.

Finding Low-Fee ATMs for Payment Methods in Europe for Travelers

ATM access remains essential for obtaining local currency, but fees can quickly accumulate without proper planning.

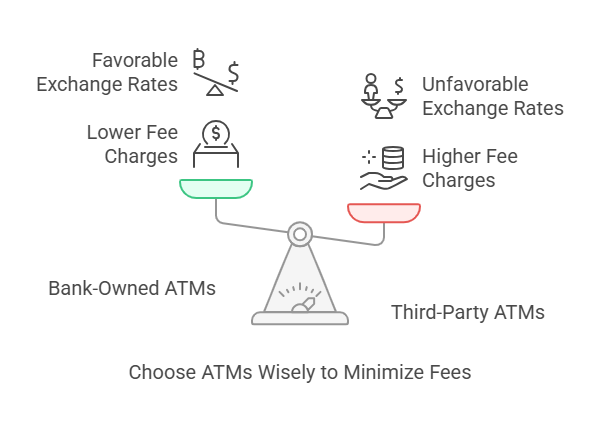

Bank-Owned vs. Third-Party ATMs

The ownership of an ATM significantly impacts the fees you’ll encounter:

- Bank-Owned ATMs: Operated by major financial institutions, these typically charge lower fees or no local fees at all

- Third-Party ATMs: Independent operators like Euronet often charge significantly higher fees and may offer less favorable exchange rates

- Country-Specific Networks: In the Netherlands, look for “Geldmaat” ATMs (bank-operated); in Belgium, withdraw euros from local bank ATMs

Visual identification of bank-owned ATMs is relatively straightforward – they typically feature prominent bank branding and are often located at or near bank branches.

ATM Locator Tools and Resources

Several tools can help locate suitable ATMs during your European travels:

- Visa’s Global ATM Locator: Searchable database of Visa-compatible ATMs worldwide

- Mastercard ATM Finder: Similar tool for Mastercard holders

- Banking Apps: Many banks offer ATM locators within their mobile applications

- Maps Applications: Google Maps and similar services can identify nearby bank branches with ATMs

Using these resources before heading out for the day can help you plan convenient cash withdrawal locations along your route.

Strategic ATM Usage

To minimize fees associated with ATM withdrawals:

- Withdraw Larger Amounts Less Frequently: This reduces the impact of per-transaction fees

- Always Decline Dynamic Currency Conversion (DCC): Choose to be charged in the local currency rather than your home currency to avoid unfavorable exchange rates

- Use Fee-Reimbursing Accounts: U.S. travelers can leverage accounts like Charles Schwab Checking, which reimburses all ATM fees worldwide

- Check for Partner Banks: Some banks have international partnerships that reduce or eliminate fees at specific foreign ATMs

You also may like: Ultimate Guide to Traveling to Europe: Everything You Need to Know.

Avoiding Currency Exchange Fees Through Strategic Planning

Currency exchange represents one of the largest potential areas for unnecessary fees during European travel. Strategic approaches can save you significant amounts.

Pre-Travel Currency Considerations

Before departing for Europe, consider these preparation strategies:

- Order Currency from Your Home Bank: Some banks offer competitive rates for pre-trip currency orders, though delivery fees may apply for smaller amounts

- Research Exchange Rates: Understand the current mid-market rates through resources like XE.com or Wise to recognize unfavorable offers

- Notify Your Bank of Travel Plans: Prevent card blocks by informing your bank of your travel dates and destinations

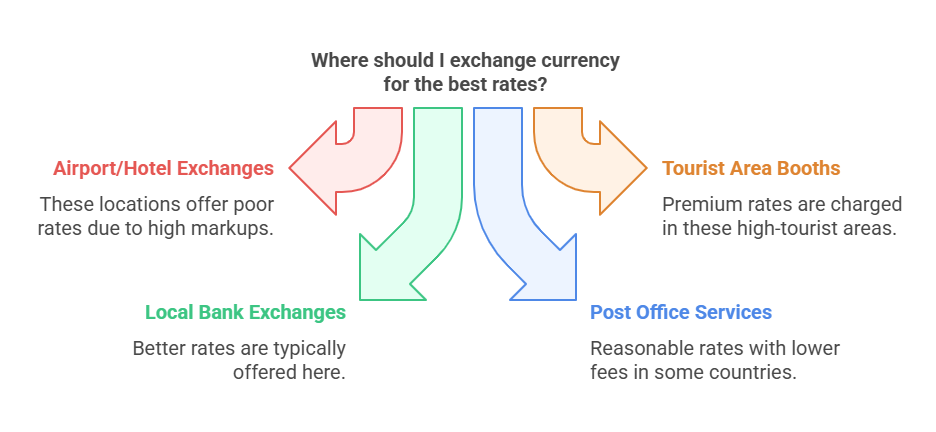

Exchange Locations to Seek and Avoid

The location where you exchange currency dramatically impacts the rates you’ll receive:

- Avoid Airport and Hotel Exchanges: These typically offer the least favorable rates, with markups of 10-15%

- Skip Tourist Area Exchange Booths: Establishments in high-tourist areas often charge premium rates

- Prefer Local Bank Exchanges: If you must exchange cash, local banks typically offer better rates than dedicated exchange services

- Consider Post Office Services: In some European countries, post offices offer reasonable exchange rates with lower fees than tourist-area exchanges

Understanding and Avoiding DCC (Dynamic Currency Conversion)

DCC represents one of the most common hidden fees facing travelers:

- What Is DCC?: A service that offers to charge your card in your home currency rather than the local currency

- The Hidden Cost: DCC typically includes a markup of 3-7% over the actual exchange rate

- Identifying DCC: When a terminal or merchant asks if you want to pay in your home currency, always decline

- Your Rights: Under EU regulations, merchants must disclose DCC as optional and provide information about any associated fees

Always insist on being charged in the local currency to ensure your card issuer’s exchange rate applies, which is almost always more favorable than DCC rates.

Currency Exchange Apps and Tools for European Travel

Technology offers powerful tools to help travelers make informed currency decisions while abroad.

Top Currency Exchange Apps

Several applications provide real-time information and services for currency management:

- Xe Currency Converter: Offers real-time exchange rates for over 130 currencies with rate alerts for target exchange rates

- Wise Currency Converter: Provides mid-market exchange rates for comparison and facilitates low-fee international transfers

- Currency Converter Plus: Displays real-time and cached exchange rates for 170 currencies with historical data for trend analysis

- Easy Currency Converter: Supports over 200 currencies with both live rates and offline functionality

These apps help you stay informed about current exchange rates, enabling more cost-effective currency decisions during your travels.

Features to Prioritize in Exchange Apps

When selecting a currency app for your European journey, prioritize these capabilities:

- Real-Time Updates: Ensure the app provides current exchange rates rather than delayed information

- Offline Functionality: Essential for areas with limited connectivity

- Rate Alerts: Notifications when currencies reach your target exchange rates

- Calculator Features: Built-in tools to quickly determine equivalent values across currencies

- Multi-Currency Support: Coverage for all currencies you’ll encounter on your itinerary

Integrating Apps into Your Payment Strategy

To maximize the benefits of currency apps:

- Check Rates Before Exchanges: Verify current rates before approaching any exchange service

- Compare Offered Rates: Use the app to calculate the effective rate being offered by exchange services

- Set Rate Alerts: If your trip is flexible, set alerts for favorable exchange conditions

- Track Expenses: Some apps include expense tracking features to help manage your travel budget across multiple currencies

Using US Bank Accounts with Payment Methods in Europe for Travelers

For American travelers, selecting the right banking products can dramatically impact European travel experiences.

Fee-Friendly US Bank Accounts

Some US banking products are specifically well-suited for European travel:

- Charles Schwab High Yield Investor Checking: Offers unlimited worldwide ATM fee reimbursements and no foreign transaction fees (requires opening a linked brokerage account)

- Capital One 360: Provides no foreign transaction fees and no ATM fees from Capital One (though ATM operator fees may apply)

- Fidelity Cash Management Account: Reimburses all ATM fees worldwide with no minimum balance requirements

- SoFi Checking: Offers ATM fee reimbursements up to a monthly limit and no foreign transaction fees

These accounts typically require advance planning, as application and card delivery may take several weeks before your departure.

US Digital Banking Alternatives

Digital banking options offer streamlined alternatives to traditional accounts:

- Wise Multi-Currency Account: Provides competitive exchange rates and limited free ATM withdrawals

- Revolut: Offers excellent exchange rates with free ATM withdrawals up to monthly limits

- N26: Available to US customers with fee-free international purchases and limited free ATM withdrawals

These services typically offer faster account setup than traditional banks, making them suitable options for near-term travel plans.

US Credit Card Considerations for Europe

Several US credit cards offer specific advantages for European travel:

- Chip and PIN Capability: Some US cards now offer true Chip and PIN functionality for unattended European payment terminals

- No Foreign Transaction Fee Cards: Options from issuers like Capital One, Chase, and Discover eliminate the typical 3% foreign transaction fee

- Travel Insurance Benefits: Many travel-focused cards include trip interruption, cancellation, and emergency medical coverage

Review your existing credit cards for international benefits before applying for new products, as you may already have suitable options in your wallet.

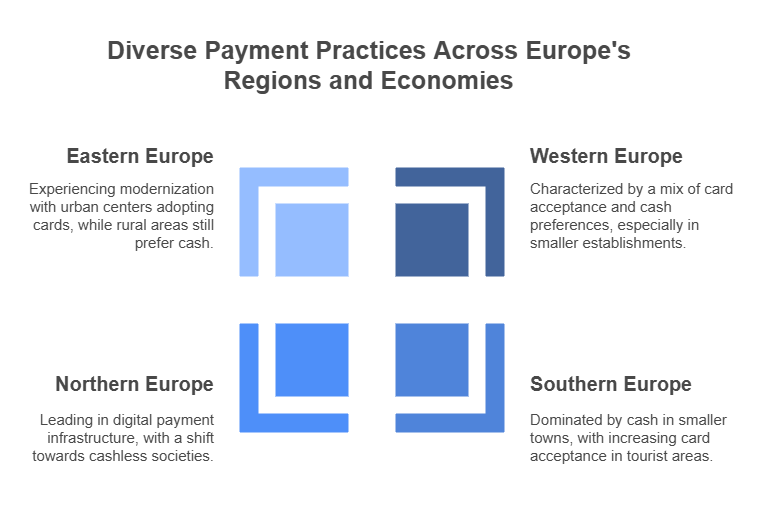

Country-Specific Payment Considerations Across Europe

Payment preferences and infrastructure vary significantly across European regions.

Western Europe Payment Landscapes

- France: While cards are widely accepted, small merchants may have minimum purchase requirements for card payments or prefer cash

- Germany: Surprisingly cash-oriented for its economic development, with many restaurants and shops operating cash-only

- Netherlands: Highly card-friendly, with widespread acceptance of contactless payments; local debit card system “Maestro” dominates

- Belgium: Bank-operated ATMs remain common, making it a good first stop to withdraw euros in cash-friendly environments

Southern Europe Payment Patterns

- Italy: Smaller towns and rural areas remain heavily cash-dependent, while major cities accept cards at most establishments

- Spain: Card acceptance is widespread in tourist areas, though smaller tapas bars and markets often prefer cash

- Greece: Cash dominates in many scenarios, especially on islands and in smaller communities

- Portugal: Increasingly card-friendly, though small businesses in non-tourist areas may prefer cash

Northern Europe’s Digital Leadership

- Sweden: Nearly cashless society with cards and mobile payments accepted almost everywhere

- Finland: Highly digitized payment infrastructure with minimal cash usage

- Denmark: Pioneer in digital payments with limited scenarios requiring cash

- Norway: Predominantly cashless with excellent digital payment infrastructure

Eastern Europe Considerations

- Poland: Rapidly modernizing with good card acceptance in urban centers, while rural areas remain more cash-dependent

- Czech Republic: Tourist areas widely accept cards, but smaller establishments and markets often require cash

- Hungary: Urban centers embrace card payments, while rural areas and traditional markets remain cash-oriented

- Croatia: Coastal tourist zones offer good card acceptance, while inland regions may require more cash

Security Considerations for Payment Methods in Europe for Travelers

Protecting your financial information remains essential throughout your European journey.

Physical Security Measures

To protect your payment methods from theft or loss:

- Use a Money Belt or Hidden Pouch: Keep the majority of your cards and cash concealed under clothing

- Maintain a Separate Day Wallet: Carry only what you need for the day’s activities

- Utilize Hotel Safes: Store extra cards, cash, and travel documents when not needed

- Be Vigilant in Crowded Areas: Tourist hotspots often attract pickpockets targeting visitors

Digital Security Practices

Protect your payment information in increasingly digital environments:

- Use Secure Networks: Avoid conducting financial transactions over public Wi-Fi

- Enable Two-Factor Authentication: Add this extra security layer to banking and payment apps

- Monitor Accounts Regularly: Check transactions daily to quickly identify unauthorized activity

- Install Security Updates: Keep devices and financial apps updated with the latest security patches

Contingency Planning

Prepare for potential payment complications:

- Carry Multiple Payment Methods: Never rely on a single card or payment type

- Store Emergency Contacts: Keep your banks’ international customer service numbers readily accessible

- Have Emergency Cash: Maintain a small amount of emergency currency in a separate, secure location

- Document Card Details: Record card numbers, expiration dates, and bank contact information (stored securely)

Planning Your payment methods for Europe travel

Creating a comprehensive plan before departure ensures smoother financial experiences during your European adventure.

Pre-Trip Financial Preparations

Complete these tasks before leaving home:

- Notify Financial Institutions: Inform all card issuers of your travel dates and destinations

- Verify Card Expiration Dates: Ensure none of your cards will expire during your trip

- Research Foreign Transaction Fees: Understand the fees associated with each of your payment methods

- Check Daily Limits: Verify ATM withdrawal and purchase limits for your cards

- Update Contact Information: Ensure your financial institutions have your current mobile number for verification purposes

On-Arrival Financial Steps

Upon reaching your first European destination:

- Withdraw Local Currency: Obtain a moderate amount of cash from a bank-affiliated ATM

- Test Your Primary Card: Make a small purchase to verify it works properly internationally

- Download Relevant Payment Apps: Install any country-specific payment applications

- Locate Nearby Bank ATMs: Identify convenient cash access points near your accommodation

Ongoing Financial Management

Throughout your journey:

- Track Expenses Across Currencies: Use a travel expense app to monitor spending in multiple currencies

- Regularly Check Account Activity: Review transactions to quickly identify any unauthorized charges

- Maintain Receipt Records: Keep important receipts, especially for larger purchases

- Replenish Cash Strategically: Plan ATM visits to minimize fees while maintaining adequate cash

End-of-Trip Considerations

As your European adventure concludes:

- Plan for Remaining Currency: Spend down local currency or exchange it before departure

- Document Any Disputed Charges: Record details of any questionable transactions

- Retain Key Financial Documentation: Keep important receipts and transaction records for post-trip review

- Notify Banks of Return: Update travel notifications upon your return home

FAQ About payment methods for Europe travel

Which payment method is most widely accepted throughout Europe?

Visa and Mastercard credit and debit cards offer the most universal acceptance across Europe. While cash requirements vary by country, having a Visa or Mastercard will serve you well in most European establishments, from major cities to smaller towns.

Should I exchange currency before traveling to Europe?

Generally, no. You’ll typically get better exchange rates by withdrawing local currency from bank-affiliated ATMs upon arrival. If you want some currency for immediate expenses, exchange only a small amount before departure—just enough to cover transportation from the airport and initial expenses.

How can I avoid ATM fees when using payment methods for Europe travel?

Use bank accounts that reimburse ATM fees (like Charles Schwab for US travelers), withdraw larger amounts less frequently, use bank-owned ATMs rather than independent operators, and always decline Dynamic Currency Conversion (DCC).

Are American Express cards widely accepted in Europe?

American Express has limited acceptance in Europe compared to Visa and Mastercard. While high-end hotels, restaurants, and larger chains often accept Amex, many smaller establishments, restaurants, and shops do not. Always carry a Visa or Mastercard as a backup.

How much cash should I carry while traveling in Europe?

Cash needs vary by destination. In Scandinavian countries, minimal cash is needed, while Southern and Eastern European countries may require more. Generally, carrying the equivalent of €100-200 in local currency covers most immediate needs while minimizing risk.

What should I do if my card is declined in Europe despite having sufficient funds?

First, ensure your bank knows you’re traveling abroad. If they’ve been notified, try another card, as some European terminals have compatibility issues with certain cards. For persistent problems, call your bank’s international customer service number—most have 24/7 support for travelers.

Is it better to pay in local currency or my home currency when offered the choice?

Always choose to pay in the local currency. When merchants offer to charge in your home currency (Dynamic Currency Conversion), they typically apply less favorable exchange rates with markups of 3-7%.

Can I use contactless payments throughout Europe?

Contactless payment acceptance is widespread across most of Europe, particularly in Western and Northern countries. The technology is standard in major urban areas, though smaller establishments in rural regions may still require chip insertion or cash.

Conclusion: Mastering Payment Methods in Europe for Travelers

Navigating the diverse payment landscape across Europe doesn’t have to be complex with proper preparation. By understanding the various currencies, payment preferences, and fee structures before your journey, you can minimize unnecessary expenses while maximizing convenience and security.

The most efficient approach combines multiple payment methods—cards with no foreign transaction fees, bank accounts that reimburse ATM charges, and strategic cash usage—tailored to your specific itinerary. Digital tools like currency apps and mobile payment platforms further enhance your financial flexibility throughout the continent.

Remember that payment preferences vary significantly between regions, with Scandinavian countries embracing nearly cashless societies while parts of Southern and Eastern Europe maintain stronger cash traditions. Adapting your payment strategy to each destination’s local practices ensures smoother transactions and more authentic experiences.

By implementing the strategies outlined in this guide to payment methods for Europe travel, you’ll navigate the continent’s financial landscape with confidence, keeping your focus where it belongs—on experiencing the rich cultures, breathtaking landscapes, and unforgettable moments that make European travel so rewarding.