Nomadicsage.com @2024

Nomadicsage.com @2024

Protection against unforeseen events can make a significant difference in your travel experience. You might think that nothing will go wrong during your trip, but the reality is that emergencies and unexpected incidents can occur at any time. From lost luggage to medical emergencies, the cost of these mishaps can be overwhelming. Investing in travel insurance not only gives you peace of mind but also safeguards your financial investment in your trip. This article will guide you through understanding travel insurance benefits for your next adventure.

The world of travel insurance can seem complex, but understanding its fundamentals is crucial for every traveler. It serves as a safeguard against unforeseen events that could otherwise lead to significant financial losses or logistical challenges during your trip.

An insurance policy specifically designed to cover various risks associated with traveling, travel insurance can protect you from trip cancellations, medical emergencies, lost luggage, and more. While it may seem like an extra expense, it provides peace of mind to help you enjoy your travels without undue stress.

Any traveler should consider the following key types of travel insurance to ensure comprehensive coverage during their journeys:

| Type | Description |

|---|---|

| Trip Cancellation Insurance | Covers non-refundable expenses if you must cancel your trip due to unexpected events. |

| Medical Insurance | Provides coverage for medical emergencies while traveling, crucial for trips abroad. |

| Emergency Evacuation Insurance | Covers costs involved in transportation to a medical facility or back home in emergencies. |

| Lost Luggage Insurance | Reimburses you for lost or delayed baggage, ensuring you have crucials while waiting. |

| Travel Delay Insurance | Compensates for expenses incurred during unexpected travel delays, such as accommodation. |

Understanding the various types of coverage can help you select a policy that suits your specific needs while traveling. Each type of insurance plays a unique role in safeguarding different aspects of your trip.

Insurance will provide you security in unpredictable situations, allowing for worry-free adventures. With travel insurance, you can find http://travel-insurance-links.com/?utm_source=blog&utm_medium=partner&utm_campaign=insurance-options peace of mind that your journey will be covered, no matter what may arise. You wouldn’t want to take unnecessary risks after investing so much in your trips. Always prioritize your safety and financial security while traveling!

One of the primary reasons travelers opt for insurance is to secure their investment. With unforeseen circumstances occurring frequently, travel insurance provides peace of mind, ensuring that you won’t face unimaginable losses if your plans suddenly change.

Trip cancellation coverage is crucial for those unexpected moments when you cannot proceed with your travel plans.

If you need to cancel your trip due to illness, emergencies, or even job-related issues, travel insurance can reimburse you for non-refundable expenses.

To say travel can present unexpected challenges is an understatement. Among the most critical is dealing with medical emergencies while abroad.

A sudden illness or injury can lead to exorbitant medical bills, especially in countries without universal healthcare.

Having travel insurance ensures you receive necessary treatment without such financial burdens, protecting your health and your finances.

Another significant aspect of travel insurance is its comprehensive coverage of medical emergencies. Consider this: a simple hospital visit for an unexpected illness can cost thousands in some regions.

Without insurance, you could find yourself facing severe financial strain when you’re simply trying to take care of your health.

Many policies even include emergency evacuation services, which are crucial if you’re in a remote area needing immediate care.

Stolen belongings can turn a dream vacation into a nightmare. When your luggage goes missing or your personal items are stolen, having travel insurance helps mitigate the financial loss.

It can provide compensation for stolen possessions, allowing you to replace crucial items without breaking the bank.

This aspect of travel insurance is often overlooked, yet it’s incredibly valuable. Imagine losing your passport or expensive electronics—these mishaps can happen when you least expect it.

With coverage, you can file a claim and recover some of your losses, ensuring that your travel experience remains as smooth as possible despite the unforeseen challenges life may throw your way.

To understand why travel insurance is so imperative, it’s important to address some common misconceptions that travelers often have.

These beliefs can lead to costly mistakes during your journeys, so let’s examine them closely.

The assumption that good health negates the need for travel insurance can be misleading. Accidents and unexpected illnesses can happen to anyone, regardless of their current health status.

Even the healthiest traveler may find themselves facing unforeseen events, such as a sudden medical emergency or a slip and fall that requires urgent care. Your health can change in an instant, and being without coverage could lead to overwhelming costs.

The perception that travel insurance is unaffordable often prevents people from investing in it.

While some plans may seem costly upfront, consider the potential financial burden of not having coverage. Emergency medical treatments abroad can quickly escalate into thousands of dollars.

Travel insurance, when compared to these costs, is a small price to pay for the protection it offers.

Plus, many travel insurance policies offer a range of affordable options tailored to fit various budgets. By shopping around and comparing different plans, you can find coverage that meets your needs without breaking the bank.

Not to mention, many policies provide comprehensive support that can save you time and money in case of emergencies, making it a worthwhile investment for any trip.

Any traveler’s financial safety net should not rely solely on credit card benefits. While some credit cards do offer certain travel protections, they might not cover everything you need.

For example, many credit cards exclude specific scenarios, such as trip cancellations due to unforeseen circumstances or emergency health situations occurring outside of your home country.

Don’t assume your credit card plan is a substitute for dedicated travel insurance. Many credit cards have limitations and may not provide enough coverage for serious incidents, leaving you vulnerable and potentially facing hefty out-of-pocket expenses.

It’s crucial to read the fine print and understand what your credit card does and does not cover before you travel.

Keep in mind that selecting the right travel insurance is crucial for a seamless journey. With so many options available, it can feel overwhelming.

The key is to focus on your specific travel needs and make informed decisions to ensure that you are adequately protected during your adventures.

Assessing your travel needs is the first step in choosing the ideal travel insurance. Consider factors such as your destination, travel activities, duration, and personal health conditions.

What kind of activities will you engage in? Are you traveling for leisure or business? Understanding these elements will help tailor your policy to cover any unexpected incidents.

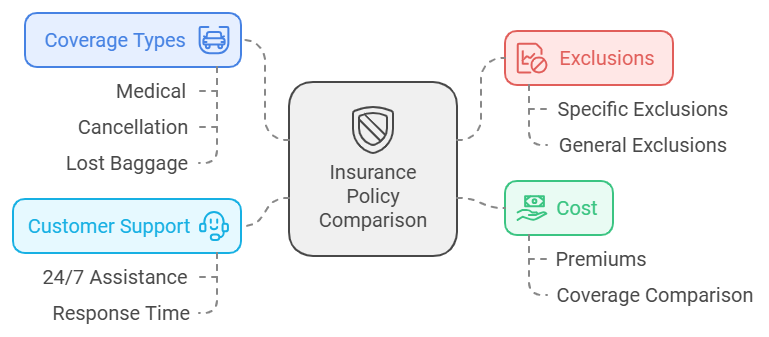

Travel insurance policies can vary greatly, so it’s necessary to compare different providers and their offerings carefully. Review the coverage limits, exclusions, and premium costs to determine which policy best aligns with your needs.

Pay special attention to customer reviews and their claim processes, as these can indicate how reliable a provider might be in times of need.

Key Factors to Compare

| Factor | Considerations |

|---|---|

| Coverage Types | Medical, cancellation, lost baggage, etc. |

| Exclusions | Understand what is not covered. |

| Cost | Compare premiums against coverage. |

| Customer Support | Look for providers with 24/7 assistance. |

Your choice should be based not only on price but also on the comprehensiveness of coverage and the reputation of the insurer.

Use online comparison tools, request quotes, and read customer testimonials to get a better idea of what each provider offers.

Keep in mind that the aim is to find a balance between cost and protection that allows you to travel with peace of mind, especially after investing a significant amount in your trips.

With this in mind, you should consider travel insurance a necessary component of your trip planning. While it may seem like an unnecessary expense at first, the peace of mind it offers in the face of unexpected events is invaluable.

From trip cancellations to medical emergencies, having coverage can save you from significant financial losses and stress during your travels.

Ultimately, investing in travel insurance allows you to focus on enjoying your journey, knowing that you are safeguarded against the unforeseen. Don’t leave your adventure to chance—prioritize your protection.

Travel insurance generally provides coverage for various unforeseen events that can occur before or during your trip. This includes trip cancellations, interruptions, or delays, as well as medical emergencies, lost luggage, and personal liability. Depending on the policy, it may also cover additional expenses such as hotel accommodations or meals if your travel is disrupted. It’s crucial to read the specifics of your policy, as coverage can vary significantly between providers.

Travel insurance can be particularly helpful in several scenarios, including:

1. Medical Emergencies: If you fall ill or get injured while abroad, medical coverage can help pay for treatment costs that may be exorbitant.

2. Trip Cancellations: If you need to cancel your trip due to unforeseen circumstances (such as illness, death in the family, or severe weather), travel insurance can reimburse non-refundable costs.

3. Lost or Delayed Luggage: Insurance can provide compensation for lost or delayed baggage, helping you cover crucial items until your belongings are returned.

4. Travel Delays: If your flight is delayed, insurance can assist with additional accommodations and transportation costs incurred.

While it may seem like an unnecessary expense at first, the peace of mind that travel insurance provides is invaluable, especially considering the potential costs of medical emergencies, trip cancellations, or lost belongings. A small investment in insurance can protect you from significant financial loss and unexpected out-of-pocket expenses during your travels. In many cases, the benefits far outweigh the cost, especially if you’re traveling internationally or engaging in high-risk activities.

Yes, most travel insurance policies can be purchased after booking your trip, but it’s best to do so as soon as possible. Many insurers offer a “look-back” benefit that can provide coverage for events that occur after your purchase but before your departure. However, timing is crucial; policies typically must be purchased before any incidents that might require a claim occur, such as a sudden illness or a change in travel plans.

When selecting a travel insurance policy, consider several key factors:

1. Destinations: Some plans cover certain regions better than others, so ensure your policy is suited for your travel locations.

2. Coverage Needs: Assess what aspects you need coverage for based on your itinerary (e.g., health insurance, baggage coverage, trip cancellation).

3. Budget: Determine how much you are willing to spend on insurance, keeping in mind the level of coverage offered.

4. Reviews: Research various providers for customer service experiences and claims processing to select a reputable company.

5. Policy Exclusions: Be sure to read and understand what is excluded in the policy to avoid being caught off guard when you file a claim.